Do You LOVE Your FAMILY?

Show Your LOVE by PROTECTING Yourself with Adequate Life Insurance in case You Die Too Soon.

"You don't buy life insurance because you are going to die, but because those you love are going to live" - My Financial Architect

We recommend to buy

TERM LIFE INSURANCE and

invest to MUTUAL FUNDS your savings.

Term Life insurance is the cheapest type of life insurance

M.O.S.T. 18

M.O.S.T. 18 stands for Multiple Option Super Term, it is an 18-term life insurance product with PDF or Premium Deposit Fund.

It’s a product by Manila Bankers Life Insurance Corporation, and launched in partnership with IMG to provide Filipino families with an affordable term life insurance with a Zero-risk savings and investment component.

M.O.S.T. 18 allows a family to have MAXIMUM LIFE INSURANCE COVERAGE at a MINIMAL COST.

How Affordable is M.O.S.T. 18?

For a 30-year old, the annual premium would only be P5,710 for a P1 million life insurance coverage to protect yourself and your family.

Yes, that's right. You only have to pay P5,710 per year (not per month, not per quarter) and you’re already insured for P1 million.

if you want to have higher coverage you must do as follows:

5,710 x 2 = 11,420 your coverage will be P2 million

5,710 x 3 = 17,130 your coverage will be P3 million

an optional investment component called PDF

What makes MOST 18 unique is that you can choose to pay more than your annual premium. And the excess cash that you pay will be invested to the PDF or Premium Deposit Fund to fund any of your financial goals (College Education, Retirement, Travel, etc.).

PDF is like a Mutual Fund.

It can earn more than a savings account, and it is very liquid. You can put more money there anytime you want. And you can also withdraw your money from it any time you need it....

with ZERO CHARGES!

FEATURES AND BENEFITS

THE FIRST AND ONLY DO-IT-YOURSELF (DIY) INSURANCE PRODUCT

Affordable

It’s a term life insurance, the most affordable type of life insurance.

Higher Fund Value

PDF allows higher growth of return. It has a ZERO-Negative feature. Even if the stock market drops in a particular year, the PDF will still give you a positive return for the year.

Premium Flexibility

Settle your contributions on a schedule that fits your lifestyle.

Withdrawal Advantage

Withdraw anytime without penalty.

Level Coverage Risk

Your family will get the life insurance coverage plus your savings and investment if unforeseen things happen to us

Emergency Fund Advantage

You already have savings in the first year.

Alternative Investment Flexibility

You are free to decide where to invest the difference.

Early Maturity

Maturity after 5/10/15/18 years.

Issue Age is 5 yo to 60 yo

Insure yourself and your whole family.

Address Various Financial Needs

The PDF can be used to fund your Retirement, Pension, Kid's Education, Travel, etc.

Convertible to Permanent Insurance

You have an option to a permanent policy.

Low Chance of Lapsation

Premiums may be settled from your PDF / investment earnings.

HOW DOES IT WORKS

30-year old with P1 million coverage is P5,710.

For the first year, there’s an additional one-time policy fee of P500. But for the next 17 years, the annual premium will be fixed at P5,710.

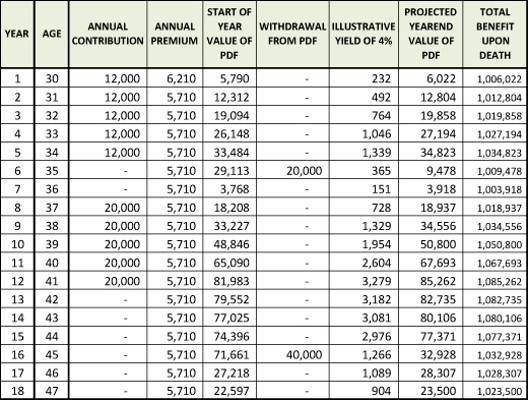

As the table shows, you were contributing P12,000 every year for the first five years. This is more than your annual premium. So the excess cash is going to your PDF.

For this illustration, we assume that the PDF investment consistently earns 4% every year. This is the rate your money that’s invested inside your PDF is growing every year.

On the 6th year, you suddenly needed P20,000 for a personal expense. Since your PDF is worth P29,113 during this time. You have the option to withdraw from it, which you did.

On the 7th year, times were difficult and your budget is tight. But because the value of your PDF can cover the annual premium. You have the option to not pay that year. And that’s exactly what you did.

Then starting on the 8th year, you chose to contribute P20,000 for the next five years. This grew your PDF amount significantly.

It grew so much that you didn’t have to contribute anymore because the PDF can already cover your annual premiums until the 18th year of the policy.

Interestingly, during the 16th year, on your 45th birthday, you chose to withdraw P40,000 from your PDF to use for your birthday party. Which is totally okay because your PDF is worth P71,661.